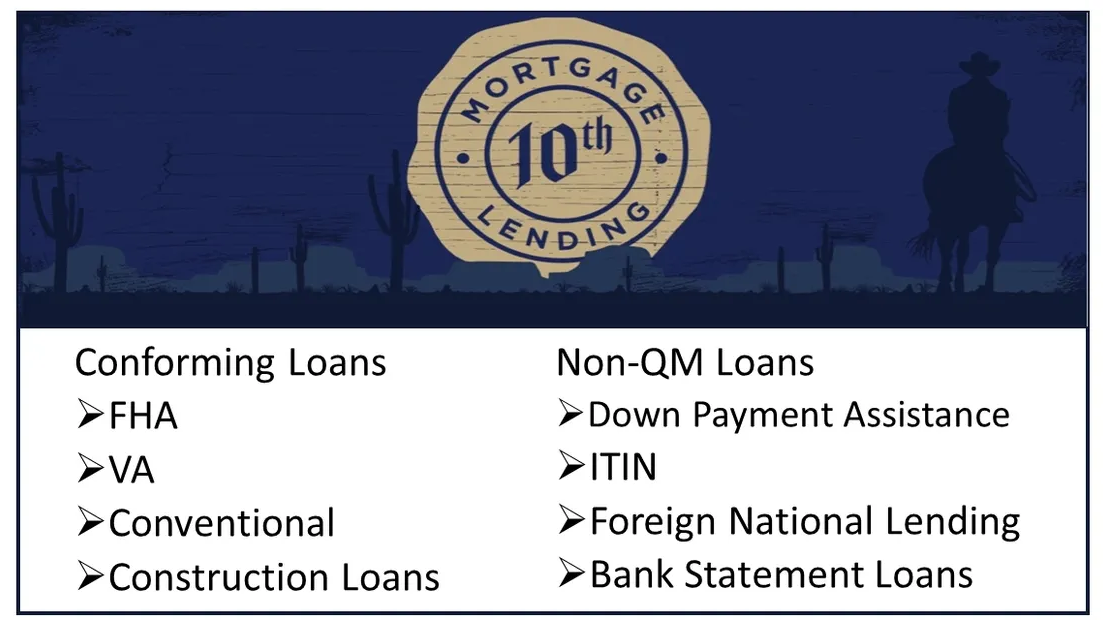

Mortgages

At 10th Mortgage Lenders, we provide a full spectrum of financing solutions to meet the needs of all types of borrowers. Whether you’re seeking traditional lending or more flexible, alternative options, we’re here to help you find the right fit.

Conforming Loans

Our conforming loan options are ideal for borrowers who meet standard lending guidelines and are looking for competitive rates and predictable terms. These include:

- FHA Loans – Government-backed loans with lower down payment requirements, great for first-time homebuyers.

- VA Loans – Exclusive to eligible veterans and active-duty military, offering zero down and favorable terms.

- Conventional Loans – Standard loans not backed by the government, often ideal for buyers with solid credit and income.

- Construction Loans – Designed to finance new home builds, with flexible draw schedules and terms during construction.

Non-QM Loans

For clients with unique financial profiles, our Non-Qualified Mortgage (Non-QM) programs provide alternative paths to homeownership:

- Down Payment Assistance – Tailored programs to help qualified buyers cover part or all of their down payment.

- ITIN Loans – Home financing solutions for individuals without a Social Security number.

- Foreign National Lending – Specialized lending for non-U.S. citizens investing in U.S. real estate.

- Bank Statement Loans – Ideal for self-employed borrowers who want to qualify based on cash flow instead of tax returns.